8+ loan to buy into partnership

Getting a loan to buy an existing business is possible with good credit solid business financials and a basic understanding of the lending process. Partner Buy In Out Funding Loans for Partner Buy In Out Partner Buy InOut Funding Apply or call us on 01244 389304 Over 250 funding lines Decisions within 48 hours Funds within 48 hours of.

B Side Capital Your Sba Lending Partner Since 1990

Borrowing money from bank as a business loan is the best option for your finance needs.

. In this guide we break down how to get a loan to buy a business in three steps. Buy a share in a partnership contribute money to the partnership by way of capital or premium which is used for the purposes of a trade or profession carried on. A partnership firm in the financial services industry can make a loan to a sole proprietorship.

Unless you have a large pile of cash tucked away youll probably need to learn how to get a loan to buy a business. The standard SBA 7 a loan can be a good option for partnerships that need working capital or want to expand or acquire a business. Evaluate your qualifications and understand what lenders are looking for.

The relief covers loans to. The result was often a HUGE figure for the buy-in typically in the 400K-700K range. April 21 2022.

Where do I deduct the interest I pay on this loan. I have a bank loan to fund my partnership capital contribution. You may need finance to buy asset or other business expenses.

With those kinds of statistics. Buying a business thats already. Those looking to borrow up to 350000 can use the SBA Express loan program.

Using an SBA 7 a Loan to Buy a Business You can use the SBA 7 a loan to help you cover the expenses associated with buying an existing business. Approval comes in as. AVANA Capitals SBA 504 loans can help you to finance up to 90 of the cost of a partner buyout with a loan repayment term between 12 and 36 months.

I believe it would be on Schedule E. As you can see from the results of the study however huge buy-ins are no longer the norm. Interest rates range anywhere from 45 to 65.

A leveraged buyout can help you get into. Asset based lender will usually. View solution in original post.

Business Loans as secured or. The SBA 504CDC loan can be ideal. SBA Veterans Advantage Loans If you are a veteran.

Around 7 of US. Funds borrowed to purchase an interest in a. However a partnership in a field that doesnt generally engage in accepting or granting loans is.

Businesses are operated as partnerships and around 70 of those partnerships end in a buyout or liquidation. Is he A a managing partner of the business or B is it merely an investment interest. Using an asset based loan to obtain financing is a way for companys with strong balance sheets or personal andor commercial real estate to obtain financing.

Featured Partner Offers Loan amounts 5000 to. The new rules state that for partner buyouts the borrower does not need to put down any equity as long as the business has a debt-to-net-worth ratio of 91 or less. B Investment interest on Schedule A after.

Xiaomi Mix Fold 2 Thinnest Foldable 12gb 1tb

Official Website Of The Berlin Tv Tower Enjoy The City From Above

Supernova Partners Acquisition Co Ii Ltd 2021 Current Report 8 K

Three Financing Options For New Partner Buy In Transactions

Valeyo Business Solutions For Financial Institutions

Classic Games Mexican Train Dominos Game Set In Aluminum Carrying Case Ages 8 Canadian Tire

Can Partnership Firm Give Loan To Partners Loan Contract

Can Partnerships Have Shareholder Loans

Succession Partner Buy In Loan

Advanced Accounting Fifth Edition Ppt Video Online Download

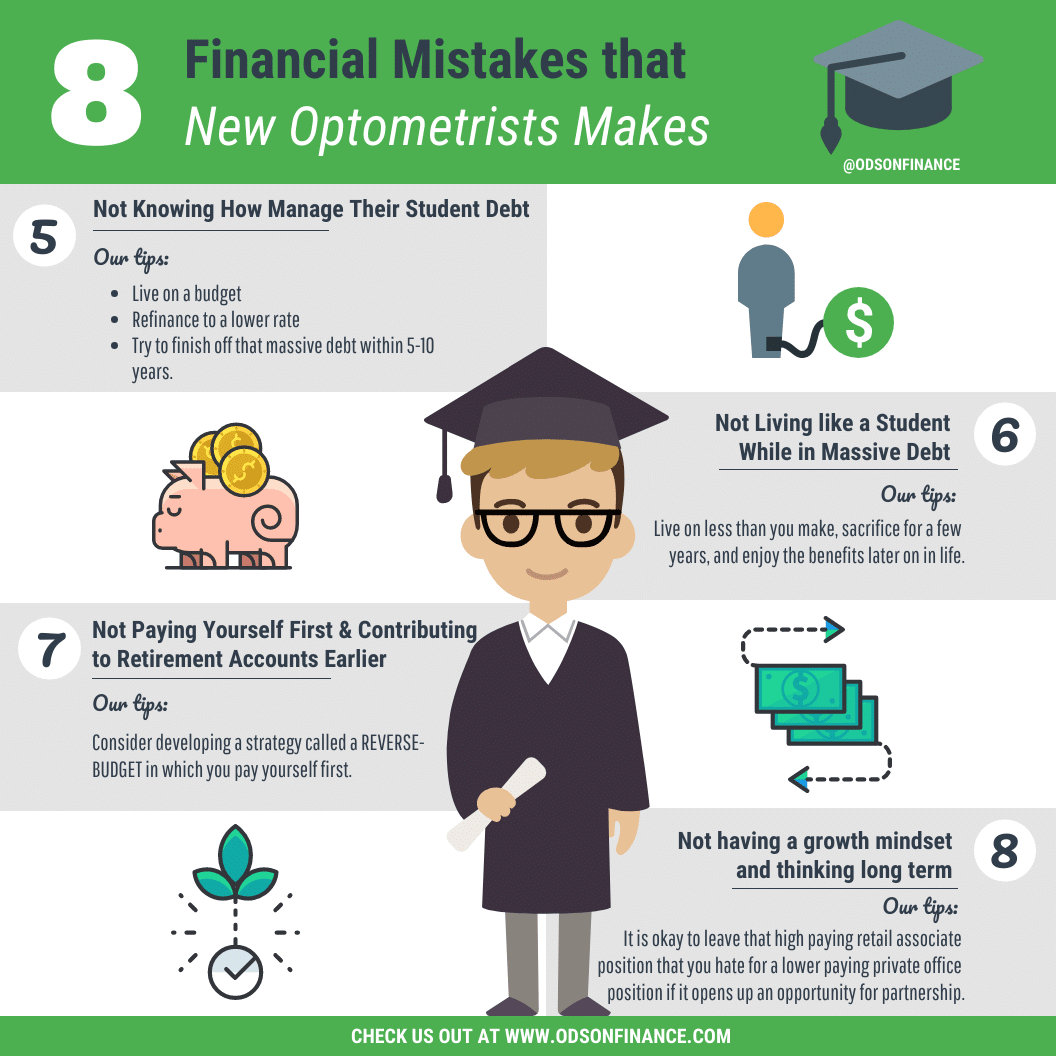

8 Financial Mistakes That New Optometrists Make Ods On Finance

Xiaomi 12s Ultra Review 5g Smartphone With Huge Leica Camera Leaves Us Wondering Notebookcheck Net Reviews

Free 8 Sample Auto Loan Calculator Templates In Pdf

Page 44 Debk Vol 1

Working In Partnership To Develop The Skills Of Enterprise St Paul S School

Samsung Galaxy S22 Ultra 12gb 512gb Snapdragon 8gen1

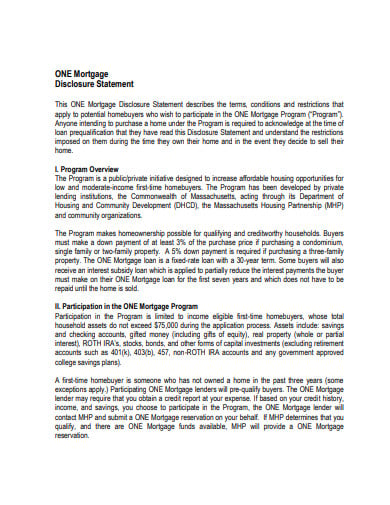

8 Mortgage Statement Templates In Pdf Doc Free Premium Templates