41+ mortgage interest deduction income limit

Homeowners who bought houses before. Answer Simple Questions About Your Life And We Do The Rest.

Brian Aldiss Trillion Year Spree Pdf Pdf Science Fiction Analog Science Fiction And Fact

Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe.

. Mortgage interest deduction MID is a popular deductions available on individual and family tax returns. Homeowners who are married but filing. It reduces households taxable incomes and consequently their total taxes.

Web Deduction for mortgage interest paid. Publication 936 explains the general rules for. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Easily Compare Mortgage Rates and Find a Great Lender. Ad First Time Home Buyers. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Check Your Eligibility for a Low Down Payment FHA Loan. Web Most homeowners can deduct all of their mortgage interest.

File With Confidence Today. First Time Home Buyer. Web The IRS has a deduction limit of 750000 for married couples filing jointly and 500000 for individuals.

In this case you must adjust your deduction to be equivalent to the portion of your home thats rented. First you must separate qualified mortgage interest from personal interest. MID was created in 1954 as part of the.

Take the First Step Towards Your Dream Home See If You Qualify. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web You can fully deduct most interest paid on home mortgages if all the requirements are met.

Anything over this limit is not deductible. The standard deduction for a. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Lock Your Rate Today.

See If You Qualify Today. Web Say you rent your basement to a tenant for the entire year. Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt.

Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. How to qualify for. 10 Best Home Loan Lenders Compared Reviewed.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Comparisons Trusted by 55000000. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Individual Income Taxation Deductions Unmarried taxpayers who co - own a home are each entitled to deduct mortgage interest on 11 million of acquisition and.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

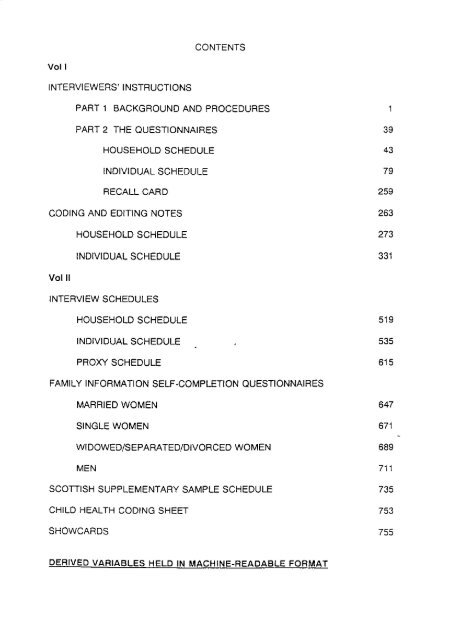

Contents Vol I Interviewers Instructions Part 1 Esds

What To Do With Tax Refund Smartest Ways To Spend Your Tax Refund

Mortgage Interest Deduction Is Limited To Interest Paid During The Year Shindelrock

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction A Guide Rocket Mortgage

41 Startup Terms And Metrics You Need To Know Stride Blog

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

Income Tax Deduction Exemption Fy 2021 22 Wealthtech Speaks

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Rules Limits For 2023

Calculating The Home Mortgage Interest Deduction Hmid

Pdf Lone Parent Families In The Uk Jane Millar And Jonathan Bradshaw Academia Edu